Capital Gain – How to Maximize Your Profit

Capital Gain Vs Rental Yield (Investment)

Let’s compare is capital gain or rental yield better.

Tax Rate

Capital Gain from Sale of Property

Rental Yield Non-owner-occupier Residential Tax Rates (Residential Properties)

Conclusion: Capital Gain have 0% Tax and Rental Yield have 10% to 20% tax for investment.

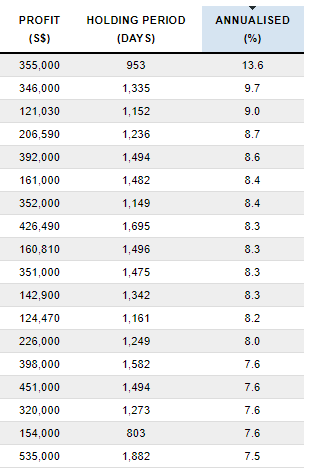

Highest Capital Gain in Singapore Property

The Highest Capital Gain (Annualized) per year I have seen is 13.6%

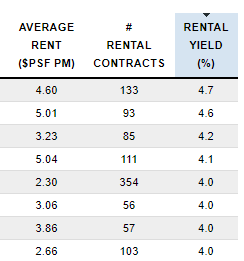

Highest Rental Yield in Singapore Property

The Highest Rental Yield Residential Property Project in Singapore is getting around 4.7%

Conclusion: The fastest way to get profit is via Capital Gain.

How to Find a Property with High Capital Gain Potential?

What are the options available?

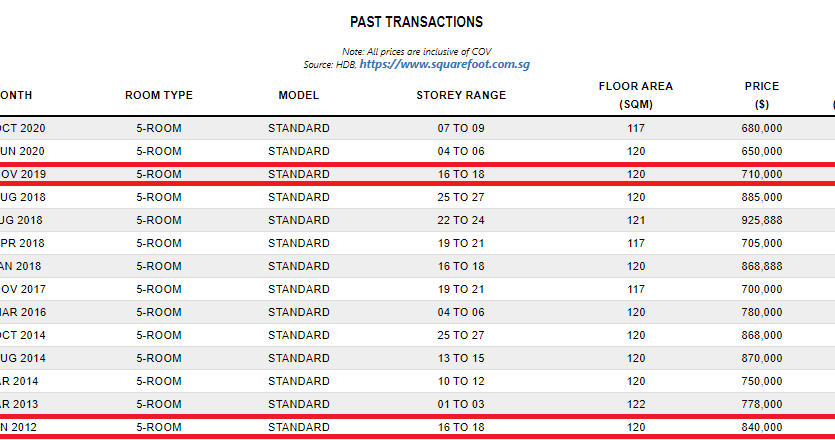

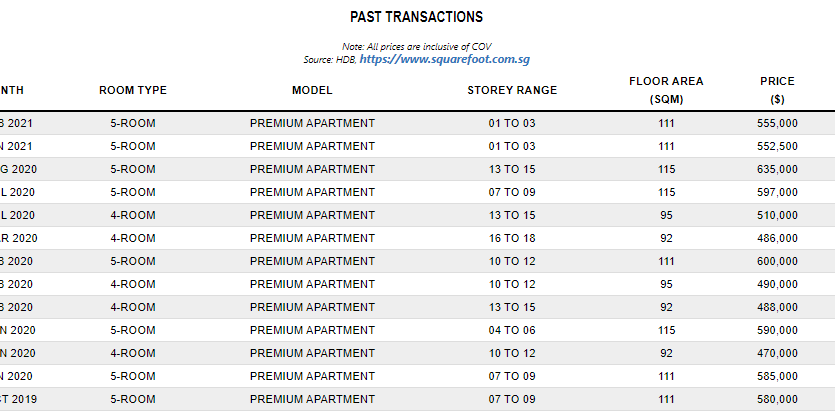

Resale HDB $840k =>$710k

After 7 years Made a Loss of $130k

BTO HDB $400k => average $550k

After 3 years of construction and 5 years to MOP (Total 8 years) get 37.5% gain (37.5% / 8 years = 4.68%) or $150k gain ($150k /8 years= $18.75k / year)

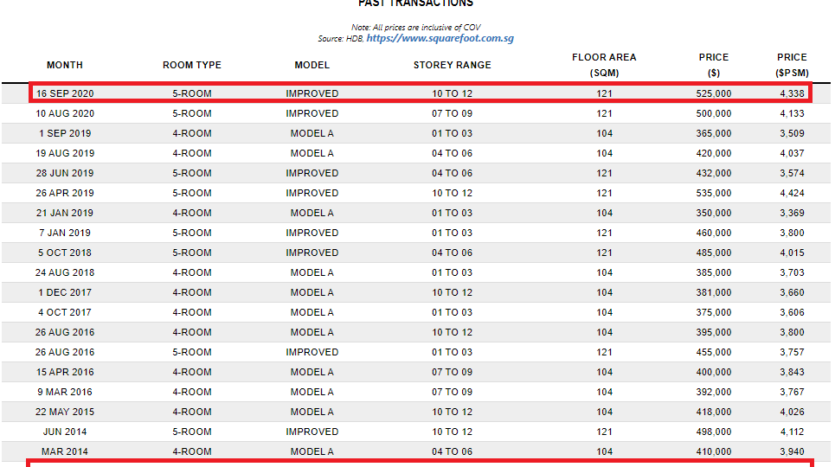

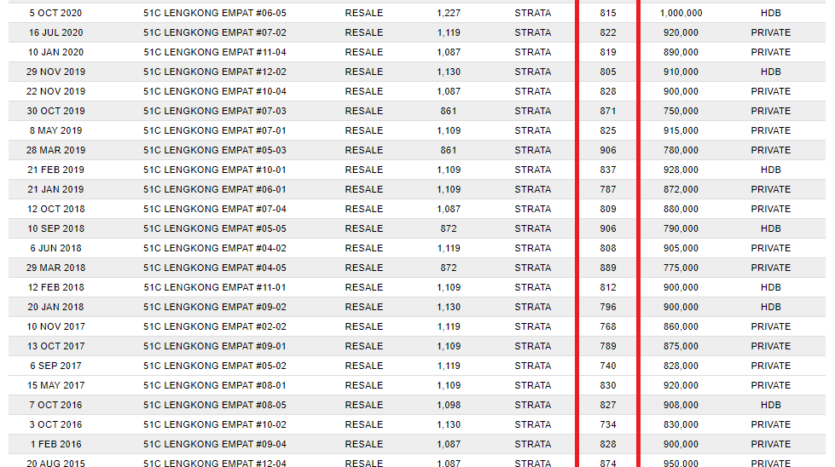

Resale Condo After 6 years psf range drop from $900+psf to 800+psf

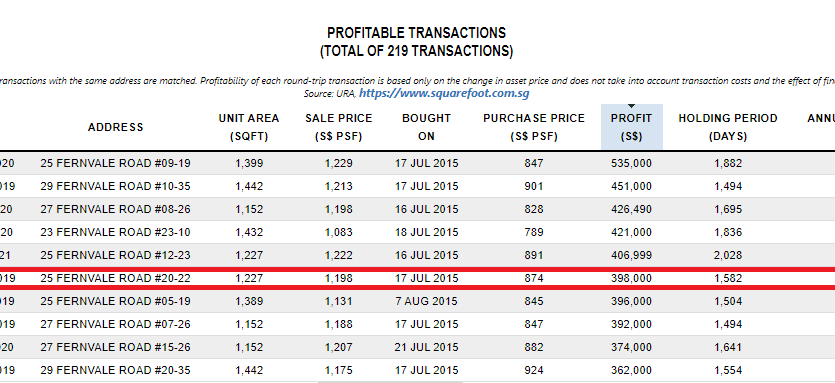

New Launch Condo $1,072,398 =>$1,469,946

After 4 years Made 7.6% per year and $398,000 ($398,000 / 1582days X 365days = $91,826 / year)

Summary:

Resale HDB $840k =>$710k After 7 years Made a Loss of $130k

BTO HDB $400k => Average $550k After 8 years Made 37.5% gain (37.5% / 8 years = 4.68%) or $150k gain ($150k /8 years= $18.75k / year)

Resale Condo After 6 years psf range drop from $900+psf to 800+psf

New Launch Condo $1,072,398 =>$1,469,946 After 4 years Made 7.6% gain per year and $398,000 gain ($398,000 / 1582days X 365days = $91,826 / year)

Conclusion: New Launch Condo have the highest potential capital gain in terms of Percentage and Quantum.