What are the payment timeline and scheme for new residential development? For buying new project from developer, buyers are required to follow the standard progressive payment scheme ruled by Urban Redevelopment Authority. That is to say, buyers make the payment according to the progress of launch and construction stage. A general guide starts from a minimum 5% down payment purchase price on booking day. The 5% down payment payment is paid by cash to grant you the option to purchase, then the rest 15% down payment can be paid by cash and/or CPF money within a period of 8 weeks. Stamp Duty and/or Additional Buyers’ Stamp Duty is requested to be paid by 14 days of exercise The reminder 80% payment will be paid progressively based on the construction advancement.

Buying Singapore Property Guide for Stamp Duty ABSD SSD New Launch Progressive Payment

When buying a Residential Property there are 3 stamp duty you need to take note of:

- Buyer Stamp Duty

- ABSD (Additional Buyer Stamp Duty)

- SSD (Seller Stamp Duty)

Buyer stamp duty in Singapore

Buyer’s Stamp Duty (BSD) is a tax levied on property buyers when they purchase any property in Singapore. The amount of BSD to be paid is based on the purchase price or market value of the property, whichever is higher. The purchase price is stated in the signed sales and purchase agreements; the market value of the property is derived from valuation reports.

The BSD rates are:

| Purchase price/Market Value | Rate in percentage for residential properties | Rate in percentage for non-residential properties |

|---|---|---|

| First S$180,000 | 1% | 1% |

| Next S$180,000 | 2% | 2% |

| Next S$640,000 | 3% | 3% |

| Next S$500,000 | 4% | 4% |

| Next S$1,500,000 | 5% | 5% |

| Remainder | 6% | 5% |

ABSD (Additional Buyer Stamp Duty)

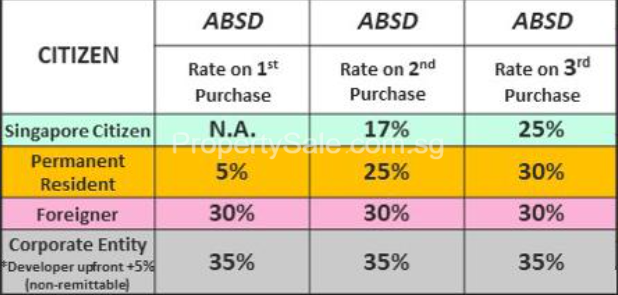

Who Needs to Pay ABSD in Singapore?

- Singapore Citizens: ABSD will be levied on the second (17%) and subsequent (25%) property purchases

- Singapore Permanent Residents (SPRs): ABSD for SPRs will be on all purchases, with ABSD rates starting from 5% for the first purchase. The second purchase will be 25%, and third and subsequent purchases will be at an ABSD rate of 30%.

- Foreigners: 30% ABSD rate for any property purchase

- Entities (companies or associations): 35% for each property (plus additional 5% non-remittable ABSD for developers)

SSD (Seller Stamp Duty)

| Up to 1 year | 12% |

| More than 1 year and up to 2 years | 8% |

| More than 2 years and up to 3 years | 4% |

| More than 3 years | No SSD payable |

Buying New Launch Property Process

Progressive payment scheme and timeline

Progressive Payment Scheme

Loan to Value

Loan-To-Value (LTV) refers to the loan amount as a percentage of the property’s value. For example, if we purchase a condominium apartment for $1,000,000 and take a loan of $750,000, the LTV is 75%.

As of 6 July 2018, the LTV limits for property purchases in Singapore are as such.

| Outstanding Housing Loans | LTV Limit | Minimum cash down payment |

| None | 75% or 55% | 5% (for LTV of 75%) 10% (for LTV of 55%) |

| 1 | 45% or 25% | 25% |

| 2 or more | 35% or 15% | 25% |

If we have no existing housing loans, the LTV limit is 75%. The more housing loans we have, the lower our LTV limit will be. If we have one existing housing loan, our LTV limit will be 45%.

For the LTV Limit, there are two figures — a higher and a lower percentage. If the loan tenure exceeds 30 years (or 25 years for HDB flats), or if the loan period extends beyond the borrower’s age of 65, then the lower LTV limit (i.e. 55%) will apply. For example, a 50-year-old buyer with no existing housing loan taking a 20-year mortgage will have an LTV limit of 55%.